We operate a regular property agency model, where we work for you to maximise the potential value of your HMO in todays market. We gather all the data, conduct a valuation, put the property to market and get it sold. Simple.

Yes. HMOs have many more moving parts when compared to single dwellings (normal properties). Our mission is to simplify the process by breaking everything down and giving you maximum transparency along the way.

If the property is priced correctly it should get a sale agreed within 28-56 days of going to market. It has been as quick as 7 days, but also sometimes things do take longer. With the correct pricing 28 days is very possible.

HMOs have more complexity associated with them. HMO licensing, planning, management, fire safety etc so they typically have more legal work associated with them and can take a bit long. With cash purchases, the average time to go through conveyancing is approx 6 weeks start to finish, but does vary depending on complexity. With mortgage purchases the additional element to factor in is the valuation, which can take from 2 to 6 weeks depending on the availability of a surveyor.

No, there are £ZERO upfront costs. Like any normal agent, we only get paid once you are sold and completed.

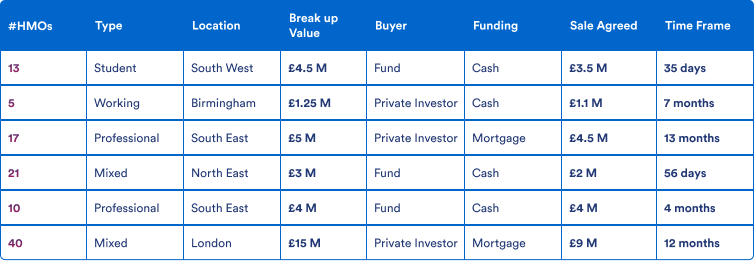

The main benefit is that you will have 100% HMO expertise from start to finish from a specialist HMO sales company that has handled over 450 HMO transactions in the last 10 years. Check out the benefits section to see them in detail.

Yes we have a standard agency agreement template which has an intial period of 16 weeks. It details what your expectations are of us, and ours of you, and it makes doing business clean, simple & enjoyable for both parties. Feel free to contact us for a copy.

If the property doesnt sell then you pay £ZERO and you are free to move on and forwards in whichever way you like.

We have 10 years experience pricing HMOs to get them sold, but normally we are led by owner. We can give you our indications but the choice is up to you. Vendors often know more about the local market conditions than we do.

We advertise to our membership base of over 5,000 active HMO investors. We also have access to all the major property portals including rightmove, zoopla, primelocation and many more.

We are both different and similar to local agents. 90% of local agents HMO transactions are unsuccessfull because they dont understand HMOs properly. 90% of our HMO transactions are successful because we have intimate knowledge of HMO properties and the HMO sales process. Feel free to compare the differences here.

Yes we have excellent relationships with professional property buying companies and cash only funds. This solution is really for people who really need speed and certainty. In exchange the price you will be offered will be less than what you will be able to achieve on the open market. We will help you manage this process to ensure you get what is promised.

Yes there are plently and we have seen in all in our 10 years of selling HMOs. Our friends over at HMOhub have put together this handy guide to help you understand the process further.

Any good quality buyer will want to see most of the following so best get your documents ready as soon as you can. HMO Floor Plan, Building Regulation Certificate, HMO Planning Documentation Fire Alarm Certificate HMO Licence Certificate Electrical Safety Certificate RICS Valuation (if available) High-Resolution Marketing Photos Rental Schedule Management Contract (if using a management agent)

Simply fill out the form on this page and book in for a discovery call with us to see how we can help you.