Ringley Group

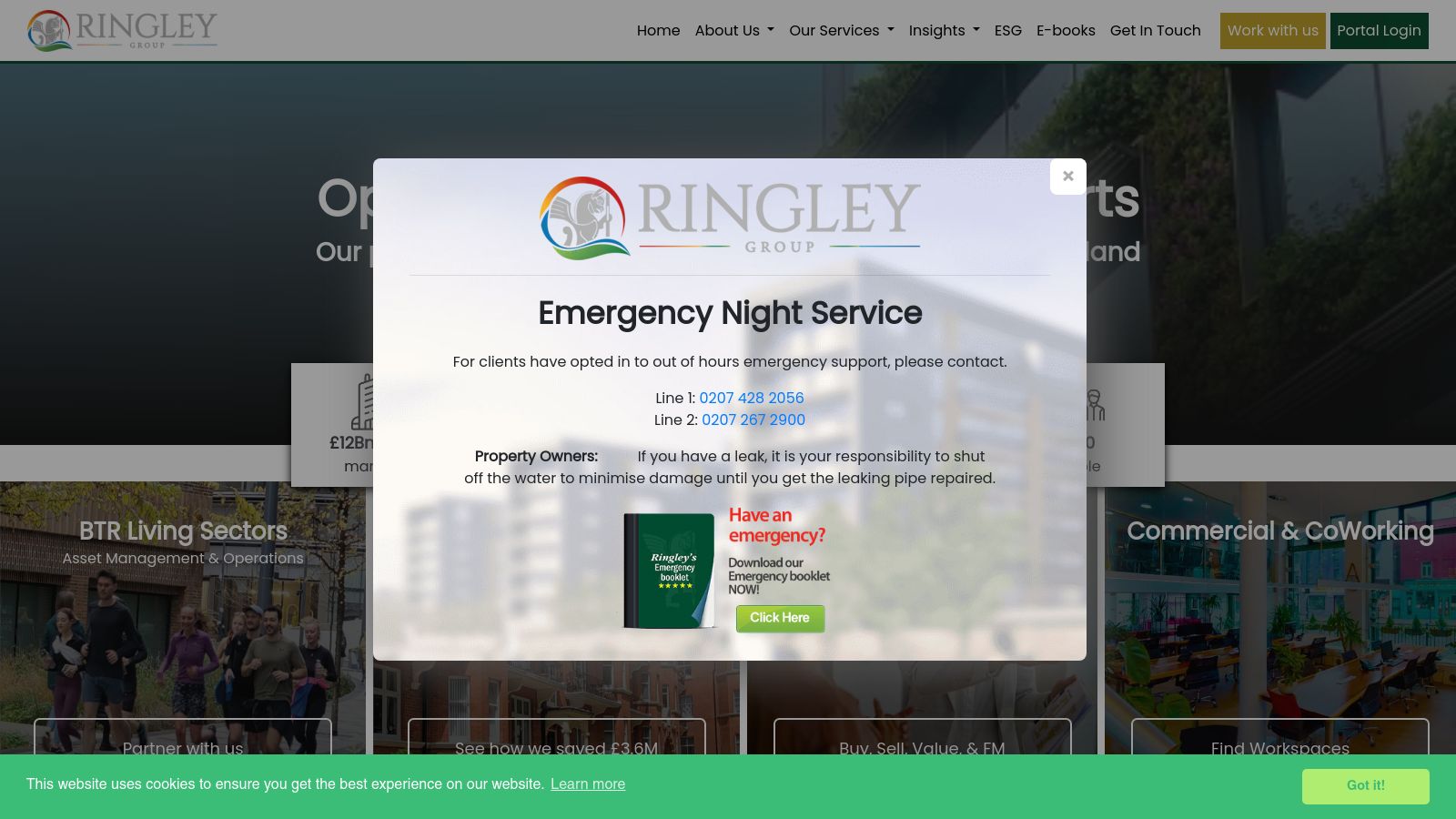

Ringley Group offers comprehensive UK asset, block The company provides services across operations, development, and management in the UK. The company provides services across operations, development, and management in the UK.

About

Ringley Group operates as a UK real estate asset manager, offering advisory and operational services across various living sectors. The firm manages thousands of homes and workspaces throughout the UK, providing a strategic lead across the full lifecycle of real estate for investors. This includes services from acquisition and project monitoring to leasing, asset stabilisation, and exit. The company is headquartered in London, with additional offices located in Manchester and Cardiff.

Ringley Group is an independent, privately owned business with over two decades of experience in residential property, managing approximately 10,000 homes. The firm's operational model integrates a full spectrum of property disciplines under one roof, which allows for in-sourcing and cost savings that are shared with clients. Ringley Group emphasizes transparency, providing clients with comprehensive data including budgets, spending, income, arrears, compliance, inspections, and meeting minutes. The company assigns named client-facing personnel from key departments such as Law, Final Accounts, Technical, and Customer Support to ensure direct communication and support.

Ringley Group is regulated by the Royal Institution of Chartered Surveyors, the Solicitors Regulation Authority, and the Financial Conduct Authority, reflecting its adherence to industry standards. Ringley Group's services extend to comprehensive property management, encompassing tenant relations, maintenance, and financial reporting for both residential and commercial property owners. The firm also provides consultancy services, offering strategic advice on property investment, development, and management decisions. Leveraging a proprietary living sectors technology platform, the company aims to enhance net operating income (NOI) and improve the resident experience.

This tech-enabled approach supports mixed-use schemes, Build-to-Rent (BTR), and leasehold properties across diverse living sectors, including student, co-living, multi-family, single-family, and later living. Within its broader residential real estate operations, Ringley Group has a dedicated focus on Purpose-Built Student Accommodation (PBSA). The firm's living sectors delivery platform, Una Living, provides an integrated asset, leasing, and student management model. Una Living offers an end-to-end solution for various stakeholders, including asset owners, institutional investors, real estate investment managers, overseas funds, family offices, and landlords in the education sector.

This platform is designed to create value through strategic partnerships, operational expenditure efficiencies, and enhanced blended internal rates of return. Ringley Group acknowledges the increasing demand for high-quality PBSA, noting a "flight to excellence" in the design and operation of student housing. Una Living currently manages an initial portfolio of 1,700 BTR units and is actively seeking further mandates in BTR, co-living, PBSA, and senior housing across the UK and Europe. The company has advised significant entities in the residential space, including Curlew, Europa, Rise, Moda, Gresham House, and PATRIZIA, demonstrating its expertise across the asset journey.

Categories

Team

Team information coming soon

We're working on enriching this page with team member information from LinkedIn.

Frequently Asked Questions

Contact

Location

Ringley House

1 Castle Road

London, London

NW1 8PR

Opening hours

Loading map...

Social Media