Mercantile Trust

Mercantile Trust is a specialist UK lender providing The company provides services across operations, development, and management in the UK.

About

Mercantile Trust operates as a specialist lender within the financial services sector, providing tailored solutions for individuals and Small and Medium-sized Enterprises (SMEs) in the UK. The company's origins trace back to its parent entity, Norfolk Capital Group, which commenced trading in 1988. This established a foundation in the financial services industry, leading to the eventual formation of Mercantile Trust in 2016. The firm was founded to address the growing demand for diverse financial solutions, specifically supporting individuals navigating complex financial situations.

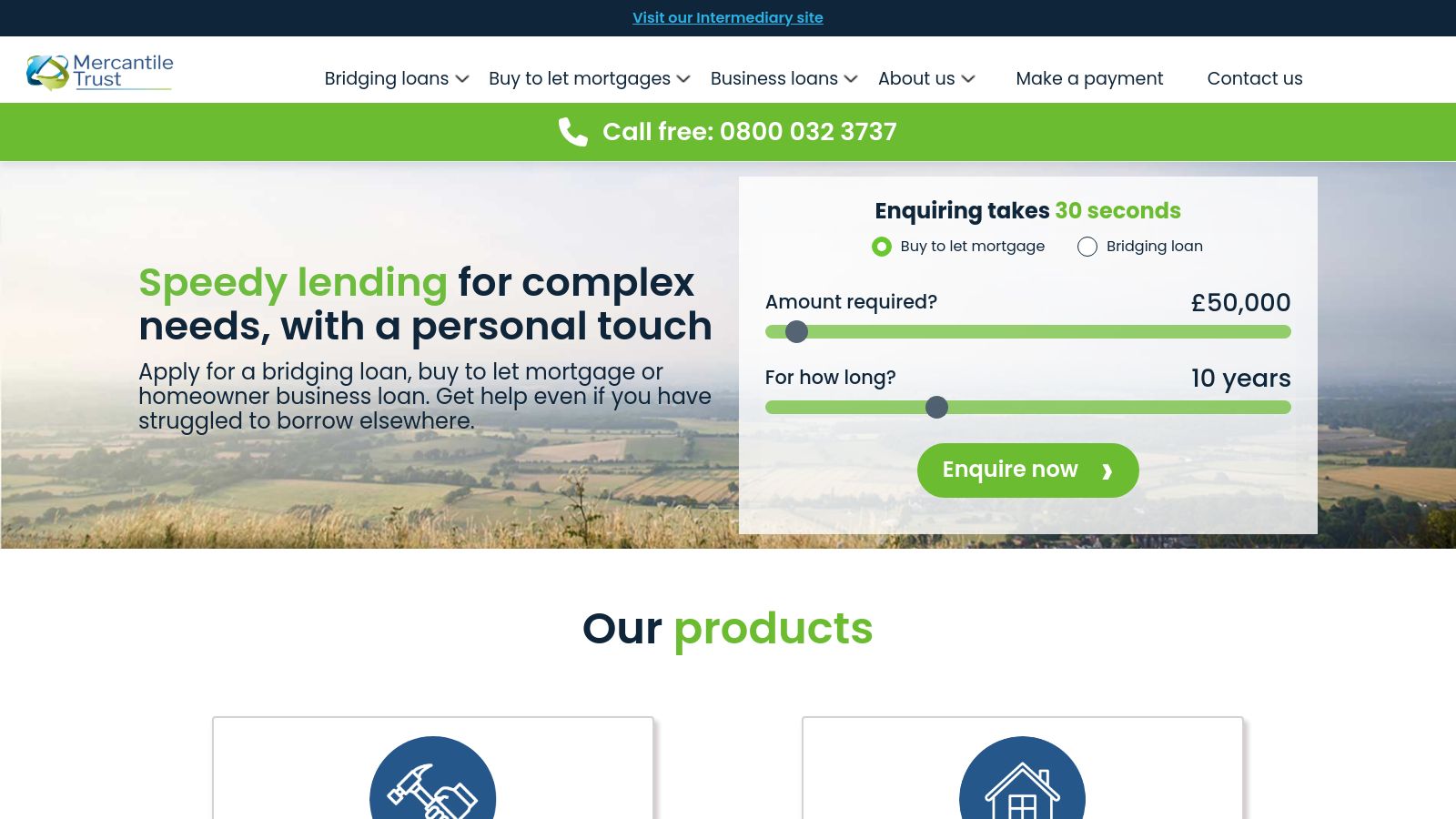

Since its inception, Mercantile Trust has focused on delivering quick, straightforward, and flexible lending options designed to meet specific customer needs. The company functions as a direct lender, while also collaborating with intermediaries to extend its financial solutions to a broader client base. Mercantile Trust's product portfolio primarily includes bridging loans, buy-to-let mortgages, and business loans. The firm is known for its common-sense approach to lending, where each application undergoes assessment by a member of its team rather than relying solely on automated systems.

This human-led underwriting process allows the company to consider the full story behind an applicant's circumstances, moving beyond numerical data such as credit scores or recent payslips. This methodology enables Mercantile Trust to assist clients who may have experienced past credit issues. Mercantile Trust aims to serve a diverse clientele, including landlords, property investors, and brokers, offering flexible and tailored loan solutions. The company supports those with complex income structures, imperfect credit histories, or individuals who require faster access to funds than traditional high street lenders might provide.

The experienced team applies its expertise to identify suitable solutions for these varied financial requirements. The firm maintains a commitment to transparency, ensuring there are no upfront fees or hidden costs associated with its lending products. The operational philosophy of Mercantile Trust is underpinned by a set of core values. These include trust, which is reflected in fostering sustainable careers for its employees and building confidence with customers and partners.

Transparency is upheld through clear communication, avoiding hidden costs or unexpected product terms. The company promotes equality, treating all individuals without regard to age, gender, race, or sexuality. Humility guides the firm to let the quality of its work and values speak for themselves. Integrity ensures that customer faith in the service prevails throughout their business relationship, while fairness dictates that unsuitable products are not recommended.

Honesty is maintained by only recommending products that genuinely benefit the customers. While Mercantile Trust provides a range of property-related financial products, including buy-to-let mortgages and bridging loans for property investors and landlords, the company's primary focus is on these lending services. The available information from the company's website and public records does not indicate that Purpose-Built Student Accommodation (PBSA) is a core or stated area of business for the firm. The company's expertise lies in facilitating property investment and business growth through its specialized lending solutions, rather than the development or management of student accommodation.

Mercantile Trust's commitment to a personalized service is grounded in experience, transparency, and a common-sense approach. The company prides itself on clear communication from the initial inquiry through to the completion of the lending process, with clients benefiting from a dedicated point of contact. This approach ensures that clients receive support and guidance tailored to their specific needs, whether they are seeking finance for property acquisition, refurbishment, or other business purposes. The firm's ability to offer fast decisions and flexible underwriting is a key aspect of its service delivery, particularly for complex cases.

Categories

Team

Team information coming soon

We're working on enriching this page with team member information from LinkedIn.

Frequently Asked Questions

Contact

Location

Building 2

Axis, Rhodes Way

Watford

WD24 4YW

Opening hours

Loading map...

Social Media