Positive Commercial Finance

Positive Commercial Finance provides development, bridging, and The company provides services across operations, development, and management in the UK. The company provides services across operations, development, and management in the UK.

About

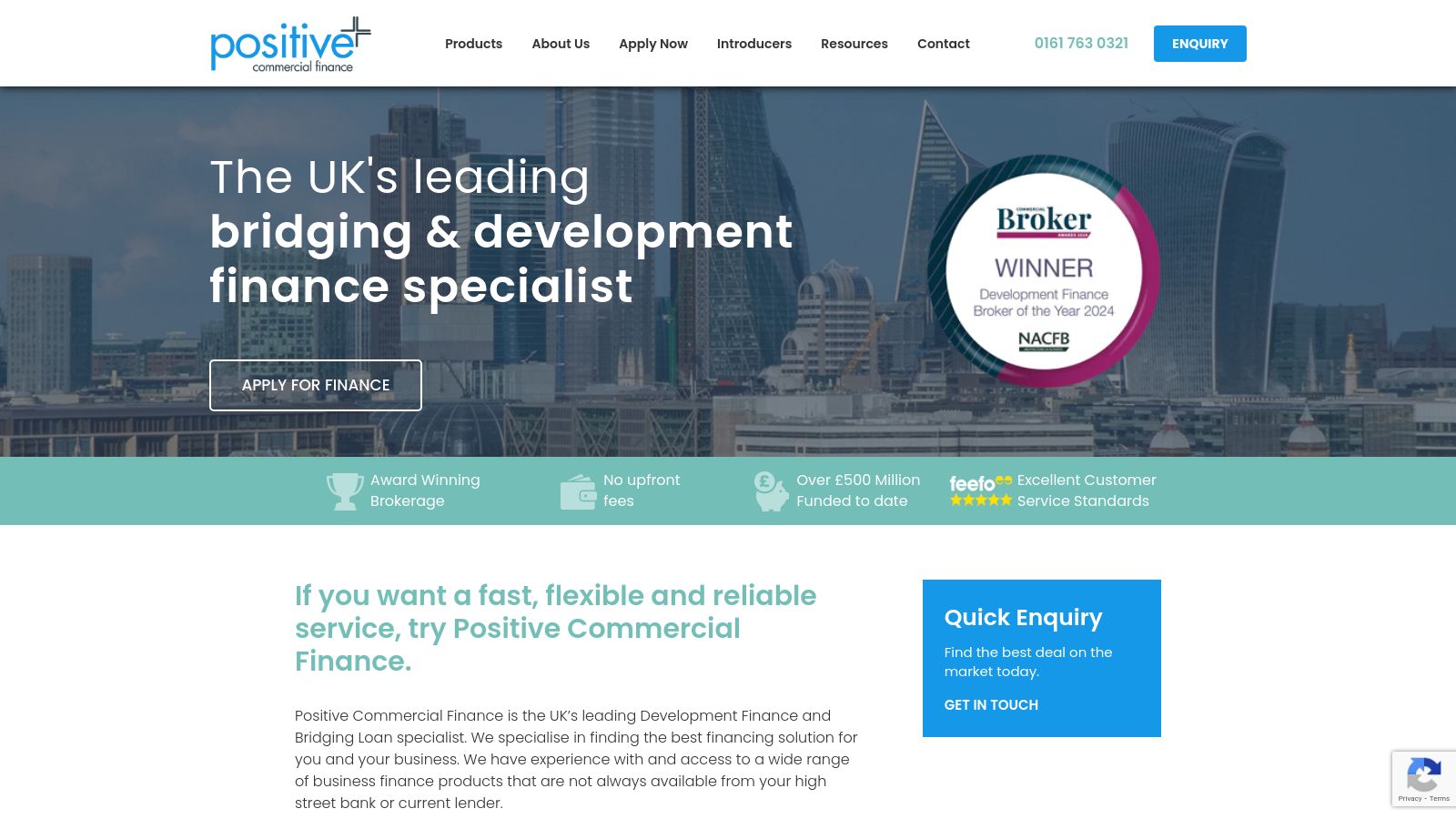

Positive Commercial Finance, operating as a trading name of Business Financial Solutions Limited, is a commercial finance brokerage established in 2007. The firm functions as an award-winning, service-driven entity, specializing in Development Finance, Bridging Loans, and Commercial Mortgages. The company provides a service with an emphasis on identifying suitable financial products for its clients. It operates as a "whole of market" commercial finance broker, aiming to source various finance deals across the UK. The company offers access to a panel of over 200 lenders, providing more than 500 financial products. Loan sizes facilitated by the firm range from £100,000 to £100 million. Positive Commercial Finance specializes in short-term funding secured by property, including Senior Debt, Stretched Senior Debt, Mezzanine Finance, Equity, Joint Ventures, and Developer Exit Loans. The firm also handles SME and Business Finance, which encompasses unsecured business loans, factoring, invoice discounting, asset finance, credit and debit card factoring, and personal asset loans. Positive Commercial Finance is authorized and regulated by the Financial Conduct Authority (FCA) with reference number 716012. The company holds full memberships with the National Association of Commercial Finance Brokers (NACFB) and the Financial Intermediary and Broker Association (FIBA). The firm operates with a policy of no upfront fees, with its remuneration being purely success-based and only becoming due upon the completion of a deal. To date, the company has facilitated over £1 billion in funding. The firm's commercial finance options extend to a diverse range of property types. These include residential, mixed-use, commercial, industrial, offices, and retail properties. Additionally, Positive Commercial Finance has experience in arranging finance for specialized sectors such as care homes, holiday lets, multi-unit blocks, and Houses in Multiple Occupation (HMOs). The company's expertise also covers student accommodation, providing financing solutions within this specific property segment. The company's approach involves a tailored, personal method to ensure clients are presented with appropriate and cost-effective options. The team of advisors possesses experience in business and finance, including an ACCA qualified advisor and individuals with board memberships in property development and investment companies. Positive Commercial Finance was founded with a focus on growth and specializes in structuring complex finance deals that benefit both the client and the lender. The firm also works with introducers, including IFAs, Mortgage Brokers, Financial Advisors, Accountants, Tax Advisors, and Solicitors, to place various commercial finance deals.

Positive Commercial Finance operates as an award-winning commercial finance brokerage, providing a comprehensive suite of financial solutions. The company assists clients across the UK in securing funding for a diverse array of commercial ventures and property types. Its services are structured to offer a fast, flexible, and reliable approach to commercial financing, catering to the varied needs of businesses and investors. The firm is dedicated to supporting its clientele through complex financial landscapes.

The company specialises in several key areas of commercial finance, including Bridging Finance, Development Finance, and Commercial Mortgages. Bridging finance offers short-term funding solutions, while development finance supports construction and renovation projects. Commercial mortgages provide long-term financing for business premises and investment properties. Beyond these core offerings, Positive Commercial Finance also facilitates Joint Ventures and provides financing options for Small and Medium-sized Enterprises (SMEs) and other general business requirements. The firm leverages an extensive network of over 200 lenders, which collectively offer more than 500 distinct financial products to meet specific client needs.

Positive Commercial Finance caters to a broad spectrum of property types within its financing activities, extending its reach across various real estate sectors. This includes funding for residential developments, mixed-use schemes, and a wide range of commercial properties such as industrial units, office spaces, and retail outlets. Significantly, the company also provides tailored financial solutions for purpose-built student accommodation (PBSA) projects, as well as care homes and other specialised property sectors. This comprehensive approach allows the firm to address varied client requirements across the entire property market, from individual investors to large corporations.

The brokerage operates under the authorisation of the Financial Conduct Authority (FCA), ensuring its adherence to stringent regulatory standards and consumer protection guidelines. Positive Commercial Finance is also accredited by the National Association of Commercial Finance Brokers (NACFB) and the Financial Intermediaries & Brokers Association (FIBA), further underscoring its commitment to professional standards and ethical practices within the industry. The team at Positive Commercial Finance possesses over 50 years of combined experience within the commercial finance sector, contributing significantly to its deep expertise and effective service delivery for clients nationwide.

Positive Commercial Finance has established a track record of significant funding achievements, having facilitated over £1 billion in finance to date for its clients. The company is equipped to handle a wide range of loan sizes, from £100,000 for smaller projects up to £100 million for large-scale investments and developments. The firm operates with a transparent policy of no upfront fees, aiming to provide accessible and straightforward financial services. Its operations are consistently underpinned by excellent customer service standards, reflecting a strong focus on client satisfaction and building lasting relationships.

Categories

Team

Team information coming soon

We're working on enriching this page with team member information from LinkedIn.

Frequently Asked Questions

Contact

Location

Warth Business Centre

Warth Industrial Park, Warth Road

Bury, North West

BL9 9TB

Opening hours

Loading map...

Social Media